Private Practice Attendings are heavily financially and emotionally invested in the enterprise they worked so hard to create. They face unique challenges safeguarding that practice if one co-owner becomes too sick or injured to work. Preserving the continuity of the practice and retaining patients is essential whether they eventually return to work or decide to sell the practice, and this is where physician practice disability insurance can help.

Outstanding Breadth of Disability Income Products

Let us help you address the unique needs of these individuals with our flexible, cost-effective business disability insurance (DI) offerings. We have the products and options for sole practitioners & partnership practices to protect their entity.Overhead Expense Insurance

Reimbursement for ongoing expenses to keep the business running, including:

- Utilities

- Rent or mortgage payments

- Taxes

- Payroll and benefits, including up to 50% of the cost of a replacement for a disabled partner

Disability Buy-Out Insurance

Funds the sale of the disabled partner’s portion of the business if a disability prevents him/her from returning to it. Highlights include:

- Easy-to-understand business valuation formula right within the policy that is easy to understand and explain to clients

- Flexibility to transfer coverage to a new business or convert to individual income protection if the DBO policy is no longer needed

Key Person Disability Insurance

Most practices have key physicians who are essential to the practice’s success. Whether these physicians are valuable because of their expertise, power, innovation, or information, losing them (even temporarily) could be incredibly detrimental to a practice. Key-Person Disability Insurance provides crucial benefits to protect the practice financially if a key physician can no longer work due to a disability. Key Person coverage provides cash flow to help practices move forward and maintain a profit if a key physician becomes disabled. In this situation, high-limit disability insurance is invaluable.

The practice could use the disability benefits to hire a temporary physician should the disabled physician’s prognosis appear to be a short-term disability. In the unfortunate circumstance of a permanent disability, benefits would then be used to help defray the costs of hiring a replacement physician, such as recruitment, training, startup, loss in revenue, and unfunded salary continuation costs. Individual High Limits Issue Policy

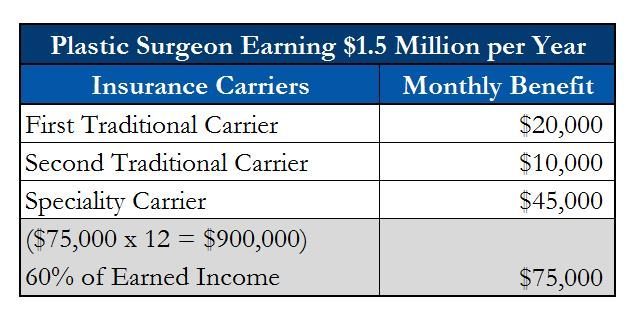

Most traditional carriers will retain maximum benefit amounts of $20,000 per month per policy, which may not be adequate for a higher-earning specialist. In such circumstances, we “layer” an additional $10,000 a month policy to increase the maximum to $30,000 per month with a tax-free benefit. However, for those extremely high earners, we have formed relationships with specialty carriers who will insure 60% of any earned income over and above the $30,000 per month from traditional carriers.

For example: